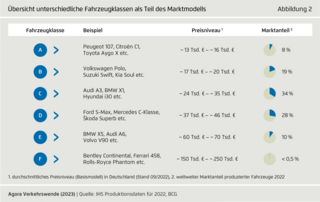

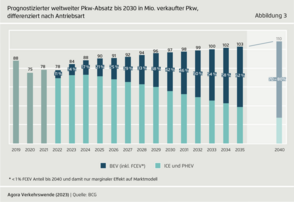

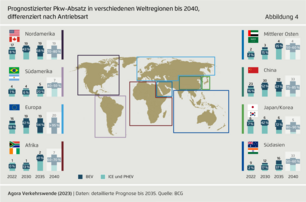

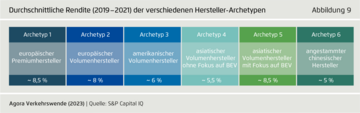

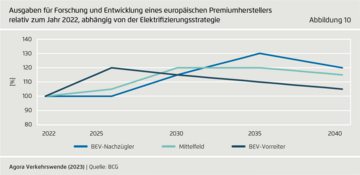

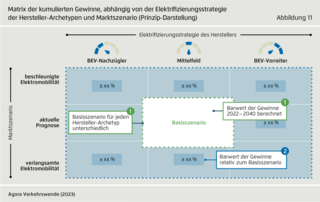

The focus of this study is the question of what financial impact the switch to electromobility will have on the strength of automobile manufacturers. To this end, Agora Verkehrswende, in collaboration with Boston Consulting Group (BCG), has used a comprehensive market model to investigate the global market shares and profits that manufacturers can secure with various electrification strategies.

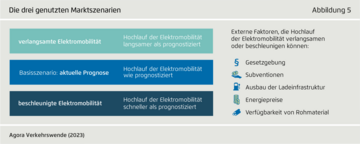

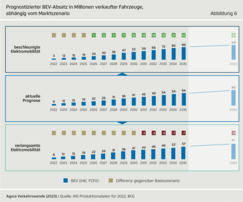

The answer depends on how the political framework evolves and what pace of electrification automakers opt for. The bottom line is that our analyses suggest that automakers need not fear a drop in profits at all - not even if structural change is accelerated. On the contrary, if they are quick and if policymakers stand by them, they can even realize a plus in profits, in addition to the social plus for climate protection.

In an earlier study - Powering the Automotive Jobs of the Future - Agora Verkehrswende and BCG already examined the question of how the type of work and the number of jobs in the automotive world of work will develop.